Customized Solutions for Your Fleet: Car Leasing Service at Our Truck Dealer

The Ins and Outs of Car Leasing: A Comprehensive Guide on Just How It Functions

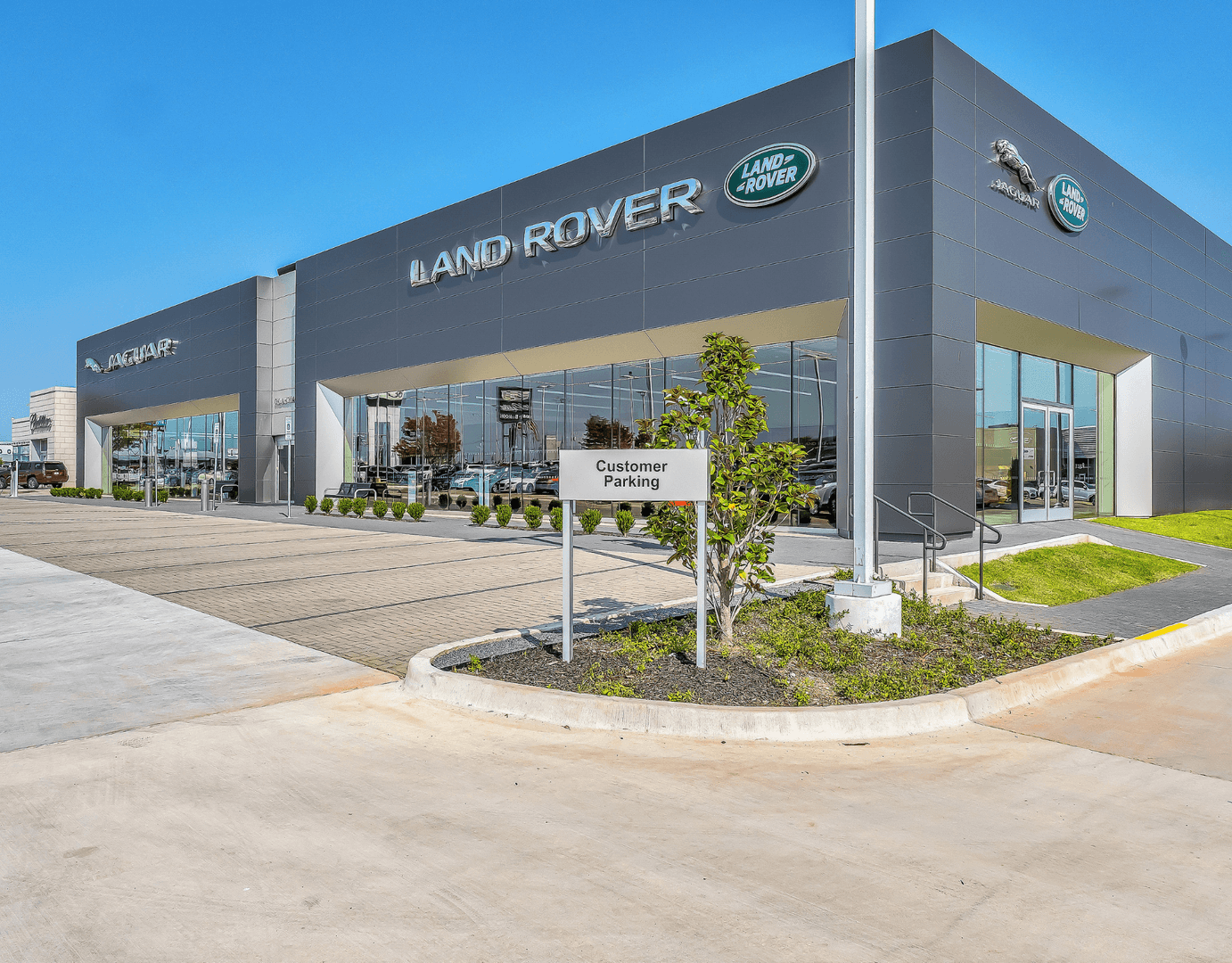

Navigating the realm of vehicle leasing can be a complex endeavor, calling for a strong grip of the intricacies entailed. From comprehending lease terms to computing settlements and discovering end-of-lease options, there are numerous elements to take into consideration when contemplating this monetary dedication. As consumers significantly select leasing over typical car ownership, it comes to be imperative to untangle the nuances of this procedure to make enlightened choices (New Land Rover Dealer). In this thorough guide, we will explore the core parts of auto leasing, clarifying the devices that drive this prominent lorry procurement method.

Advantages of Automobile Leasing

One significant advantage is the lower regular monthly repayments linked with leasing compared to buying an automobile. Leasing permits people to drive a newer vehicle with reduced upfront expenses and reduced monthly repayments given that they are just financing the lorry's depreciation throughout the lease term, rather than the whole purchase cost.

Considering that leased cars are normally under the supplier's warranty during the lease term, lessees can stay clear of the economic burden of major repair work. Leasing may offer tax obligation benefits for service owners that make use of the car for business objectives, as lease payments can typically be subtracted as an organization cost.

Understanding Lease Terms

Considering the economic advantages of car leasing, it is important to comprehend the complexities of lease terms to make informed choices concerning this car financing option. Lease terms refer to the particular conditions laid out in the leasing contract in between the lessee (the person leasing the cars and truck) and the owner (the renting company) These terms commonly consist of the lease period, monthly payment amount, mileage restrictions, damage standards, and any kind of possible costs or fines.

One vital aspect of lease terms is the lease period, which is the length of time the lessee concurs to lease the vehicle. Understanding the lease duration is important, as it affects overall costs and month-to-month payments. It is important to very carefully evaluate and comprehend all lease terms before signing the contract to stay clear of any type of shocks or misconceptions during the leasing period.

Determining Lease Repayments

Checking out the procedure of computing lease settlements loses light on necessary monetary factors to consider for people engaging in vehicle leasing arrangements. Lease settlements are normally established by considering elements such as the lorry's devaluation, the agreed-upon lease term, the cash variable (rate of interest price), and any type of extra fees. To calculate lease payments, one can use the complying with formula: Monthly Lease Settlement = (Devaluation + Finance Cost) ÷ Number of Months in the Lease Term.

Upkeep and Insurance Coverage Factors To Consider

Recognizing the upkeep and insurance coverage these details needs associated with cars and truck leasing is vital for lessees to guarantee the appropriate care and protection of the lorry throughout the lease term. Upkeep obligations vary amongst leasing arrangements, but lessees are generally expected to promote the manufacturer's recommended maintenance timetable. Failure to do so could lead to charges at the end of the lease or gap certain guarantees. When necessary., lessees need to maintain detailed documents of all maintenance and repair work to give evidence of compliance.

Pertaining to insurance, all rented lorries go to this web-site have to have comprehensive and crash insurance coverage with obligation limitations that meet or surpass the renting business's requirements. This is to protect both the lessee and the renting firm in case of a crash or damage to the lorry. It's essential to very carefully examine the insurance policy requirements detailed in the lease arrangement and guarantee that the coverage is maintained throughout the lease term. Failing to maintain adequate insurance policy protection can bring about major consequences, consisting of possible lawful issues and financial responsibilities. By meeting these maintenance and understanding and insurance commitments, lessees can enjoy a smooth leasing experience while protecting the rented automobile (Car Leasing Service).

End-of-Lease Options and Process

As completion of the lease term methods, lessees exist with various choices and a specified process for picking or returning the automobile to seek a different plan. One common option is to simply return the car to the owner at the end of the lease term. Lessees are generally responsible for any kind of excess mileage use this link fees, deterioration charges, and any various other impressive repayments as described in the lease contract.

Alternatively, lessees may have the alternative to acquire the vehicle at the end of the lease term. The purchase rate is generally predetermined in the lease contract and might consist of a residual value that was established at the beginning of the lease.

Another alternative for lessees is to sell the leased automobile for a new lease or acquisition - Land Rover Dealer. This can be a hassle-free choice for those who favor to continually drive a new automobile without the inconvenience of marketing or returning the present leased automobile

Inevitably, recognizing the end-of-lease choices and procedure is vital for lessees to make informed choices that align with their requirements and preferences.

Conclusion

Recognizing lease terms, calculating repayments, and taking into consideration upkeep and insurance policy are critical facets of the leasing process. In addition, knowing the end-of-lease alternatives and procedure is crucial for a smooth transition at the end of the lease term.

Considering that leased vehicles are normally under the manufacturer's guarantee during the lease term, lessees can avoid the economic problem of major repairs. Lease terms refer to the certain conditions detailed in the leasing contract between the lessee (the person leasing the car) and the lessor (the renting firm)One important element of lease terms is the lease duration, which is the length of time the lessee agrees to lease the lorry. Lease payments are usually identified by considering factors such as the vehicle's devaluation, the agreed-upon lease term, the cash aspect (interest rate), and any extra costs. To determine lease payments, one can utilize the complying with formula: Regular monthly Lease Payment = (Devaluation + Money Cost) ÷ Number of Months in the Lease Term.